For the tax year ending December 31, 2024, supporters of public charities may deduct their contribution as long as they itemize. This year, donors may generally contribute up to 60 percent of their adjusted gross income (AGI) for donations of cash for over a year. Contributions for non-cash assets are capped at 30 percent of AGI.

With ongoing inflation and elevated interest rates, donors are navigating a challenging financial climate. The good news is, there are still many ways you can amplify your giving while potentially reducing your tax burden this year and in the years ahead. Here are three ways to implement tax-smart giving:

1. Donate tax-free through your IRA

IRA owners aged 70½ or older have the opportunity to make a tax-free transfer of up to $100,000 ($200,000 for married couples filing jointly) to charities like Alzheimer’s San Diego each year. These transfers, referred to as qualified charitable distributions (QCDs), provide a simple and effective means for generous individuals to contribute to our cause while providing tax advantages by reducing adjusted gross income.

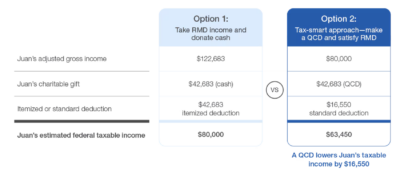

Notably, for those who are at least 73 years old, QCDs also fulfill the required minimum distribution (RMD) for the year, allowing you to support our mission while meeting your financial obligations. Donors don’t report QCDs as taxable income and may find them more tax-efficient than traditional cash donations.

Here’s an example showing how these donations can impact your tax bill:

By donating directly through an IRA, the total taxable income decreased, resulting in a lower tax bill. Click here to learn more >

2. Donate appreciated assets

Donating appreciated stocks or bonds can provide significant tax benefits. Selling appreciated stock would typically incur capital gains tax. However, contributing these assets to a charity, such as Alzheimer’s San Diego, allows you to receive a tax deduction for the entire fair-market value and completely bypass capital gains tax.

3. Donate retirement plan assets

An effortless method to create a positive impact with tax considerations is designating a charity as the beneficiary of your retirement plan, such as an IRA, 401(k), or 403(b). This usually involves completing and submitting a form to your plan’s organization. When done properly as part of an estate plan, this setup can effectively decrease the tax burden on both your heirs and your estate.

If you would like to learn more about these or other ways to give to Alzheimer’s San Diego and implement tax-smart giving into your plans, please contact Michelle Van Hoff at 858.966.3300 or mvanhoff@alzsd.org. For general help, call us at 858.492.4400 to speak with one of our dementia experts who are here to help San Diego County residents and/or those caring for someone living in San Diego County (Spanish speakers available). Also check out our free education classes, social activities, caregiver support groups, & more.

RECOMMENDED: Holiday Tips for Dementia Caregivers

Updated on December 12th, 2024